Takeaways

Annual Conference 2025 - Takeaways Document

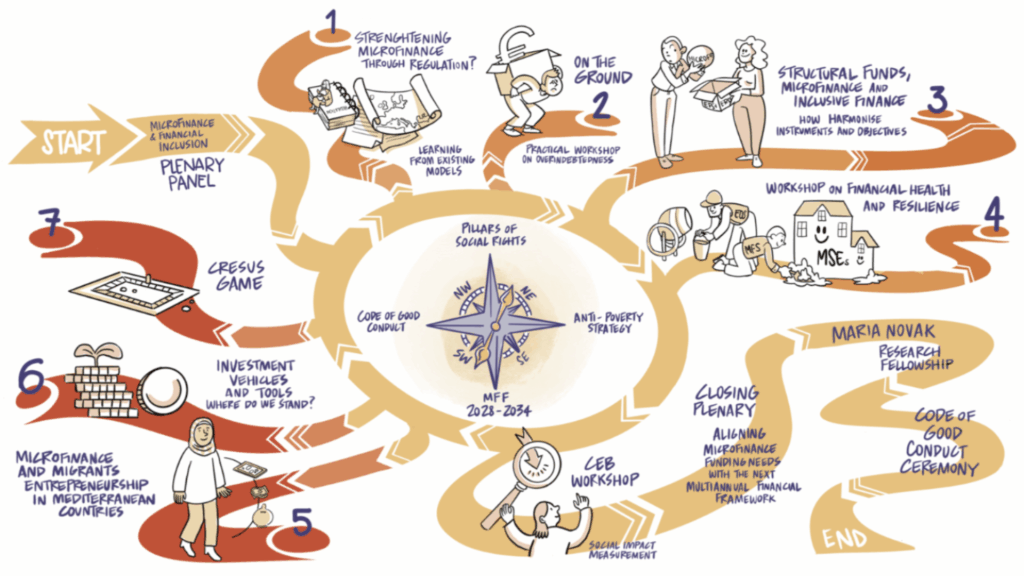

- The importance of the sector was also confirmed by the numbers from the Annual Conference. Held in Cagliari, Sardinia and organised in partnership with RITMI and CoopFIN, the event was the largest in history.

- It included no less than 352 attendees, 58 speakers, 9 panels, and 2 days of discussions and networking. It primarily aimed to address social and economic challenges at the local and regional levels, while exploring how microfinance serves as a key driver in empowering communities, fostering social cohesion, and strengthening cooperation.

- This year, we shifted our focus back to the regional and local levels, exploring ways to engage public and private actors, microfinance institutions, and entrepreneurship support organizations in strengthening the local economy and fostering social cohesion. We also addressed several key priorities for the sector, including regulation, over-indebtedness, mobilizing ESF+ funding, supporting migrants, and unlocking new funding opportunities.

- This takeaway document is meant to capture the main outcomes and recommendations from each panel and workshop and as an advocacy document to pursue our priorities.

Key recommendations to keep in mind

- Promote regional and local partnerships among financial institutions, local authorities, and organisations to build stronger dialogue and collaboration mechanisms

- Microfinance regulation – Let’s keep things simple: regulatory frameworks should be clear and proportionate, minimising compliance costs and enabling MFIs to focus on their social mission.

- Over -indebtedness: Ensure access to financial education and make it a universal skill offered by microfinance institutions as they can play a key role by offering tailored products to build financial resilience.

- ESF + “Knock Knock at MAs’ door“: Extend the number of ESF+ managing authorities implementing microcredit financial instruments and enhance coordination and peer learning among Managing Authorities to replicate successful models, such as Bulgaria’s Risk-Sharing Facility;

- Microfinance and migrants: Build bridges and promote the creation of regional and transnational networks of microfinance institutions to ensure that migrants receive consistent financial services and advisory support

- Microfinance on the EU stage: Promote microfinance social impact and improve sector visibility at the political and societal level and create three to five key indicators that all microfinance providers can consistently measure and make these accessible to organisations of all sizes.

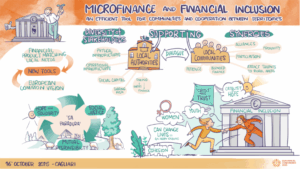

Opening panel - Microfinance and financial inclusion: efficient tools for communities and cooperation between territories

Our speakers: Giampietro Pizzo (RITMI), Jorgos Papadakis (EMN), Alessandra Barlini (Banca Etica), Panagiotis Tournavitis (Cooperative Bank of Karditsa), Diana Ghinea (REVES and Coompanion Gothenburg), Paola Bellotti (Coopfond) and Paola Del Fabro (Banco di Sardegna and BPER Group)

The workshop

The panel centered on developing innovative models and tools to strengthen regional cooperation, emphasizing that in times of global uncertainty, local environments can offer the stability and adaptability needed to align microfinance more closely with the needs of the people it serves. Building on this perspective, the workshop explored how financial institutions, policies, and local authorities can drive inclusive economic development by channeling resources to isolated areas, supporting entrepreneurial initiatives, mitigating systemic and financial risks, and fostering collaboration through interconnected enterprise networks.

Effective local development depends on strong dialogue among financial institutions, regional bodies, and organisations.

From the funding perspective, speakers emphasized the comparative advantage of the sector which lies in the ability to provide tailored-made and need driven funding instruments that could be applicable to emergencies but also for the development of local infrastructure.

Representing the microfinance perspective, speaker underlined that the key can be found in the triptych “proximity, participation, patience”. Finance should go beyond funding to act as a connector between financial intermediaries and entrepreneurs, fostering collaboration through proximity, participation, and patience. Microfinance institutions need to speak to their potential clients as well as the local authorities, in order to jointly design the necessary instruments to face i.e. the consequences of a natural disaster.

Turning to the cooperative dimension, discussions highlighted the role of community cooperatives and the key factor behind their success, which is their foundation on specific local needs. Most are based in smaller municipalities and have already drawn the attention of impact investors thanks to the unique tools and approaches they offer.

To support entrepreneurs and individuals, an emphasis should be placed on the role of authorities and municipalities as well as the social capital of the selected areas. Local authorities need greater capacity to support communities, while understanding and investing in both social and physical infrastructures is essential. Cooperation, built on shared creation and global alliances, helps overcome isolation by connecting local strengths. Finally, digitalization can enhance access and inclusion, especially in rural areas.

To keep in mind

- Promote regional and local partnerships among financial institutions, local authorities, and organisations to build stronger dialogue and collaboration mechanisms and design innovative models of governance for local development.

- Adopt the “proximity, participation, patience” approach in financial operations and strengthen relationships between MFIs, entrepreneurs, and local authorities to co-design financial instruments addressing both development needs and emergency situations (e.g., natural disasters) and promote blended finance model with specific local governance.

- Support community cooperatives as vehicles for inclusive local growth, focusing on their ability to respond to specific local needs

- Invest in both social and physical infrastructure to strengthen local resilience and foster inclusive development and empower local authorities with greater financial and institutional capacity to support entrepreneurship.

Workshop 1 - Strengthening microfinance through regulation? Learning from existing models

Our speakers: Nicola Benaglio (EMN), Brigitte Fellahi-Brognaux (European Commission), Neoklis Stamkos (Microsmart), Marco Ravaldi (Microcredito d’Impresa), Rafael Drummond (Cresacor), Simone Petrillo (EIF), Izabela Norek (Inpulse)

The workshop

In the workshop, speakers aimed at assessing the effectiveness of microfinance regulation across countries and extract lessons for future policies.

Through the examples of Portugal, Greece and Italy, the workshop explored the outcomes and limitations of different national regulatory models. The speakers discussed how regulation has influenced microfinance institutions (MFIs), funding opportunities and supported micro-entrepreneurs.

What we learned is that regulation itself is neither good or bad, its impact depends on how it’s designed. In Greece, the recent law has allowed to develop whereas the Portuguese regulation is a clear obstacle to move forward. A well-crafted, proportionate regulation fosters growth by encouraging new entrants, partnerships, and investment in the sector. On the other end, a poorly designed regulation, can hinder development by imposing banking-style requirements on MFIs or creating overly complex rules that stifle impact, sustainability, and innovation.

The workshop also provided an opportunity to understand, from an investor’s perspective, which types of regulatory models encourage investment in microfinance and which ones discourage it. And finally, what role do the EU and the European Code of Good Conduct play in shaping and harmonizing national regulatory frameworks?

The Code of Good Conduct plays a central role as both a prerequisite for EU financial instruments and a framework for fair governance and transparency. It helps strengthen MFIs, align them with market standards, and build trust in the sector. As a “soft” regulation the Code enhances access to finance and serves as a quality label within EU programs like InvestEU and ESF+. Its ongoing third revision aims to expand its role as both a quality standards and as a driver of social impact for the microfinance sector.

To keep in mind:

Microfinance regulation must:

- Stay simple: regulatory frameworks should be clear and proportionate, minimising compliance costs and enabling MFIs to focus on their social mission.

- Support access to finance: regulations should facilitate MFIs’ ability to attract investment and scale sustainably.

- Recognise microfinance specifics: regulators should account for the sector’s unique characteristics when designing supportive measures.

- Promote cross-learning and the Code: sharing best practices across countries and wider use of the Code of Good Conduct can strengthen regulation and foster innovation.

- Balance protection and inclusion: regulation should safeguard clients without creating barriers to financial inclusion.

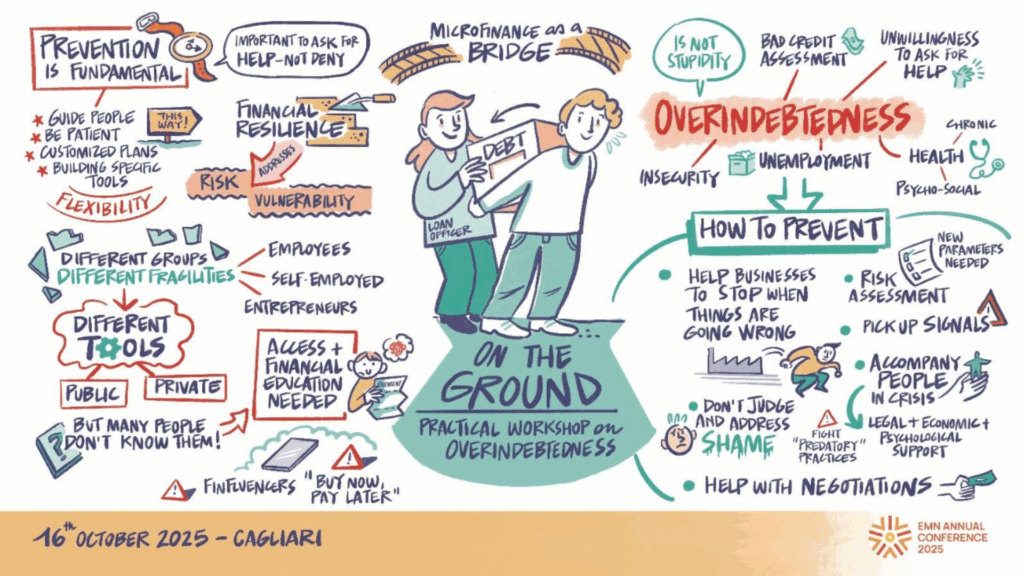

Workshop 2 - On the ground - Practical workshop on over indebtedness

Our speakers: Célia Magras (Cresus Foundation), Dieter Korczak (European Consumer Debt Network), Heidi Ceffa (Fondazione Welfare Ambrosiano), Jacqueline Zuidweg (Geldfit.nl)

The workshop

During the workshop, speakers emphasised that education, awareness, and integrated support are crucial to prevent and address over-indebtedness among both employees and the self-employed. While employees face easy access to credit and lack financial literacy, self-employed individuals struggle with limited access to finance and insufficient business and administrative knowledge.

Financial education should be a basic skill for all, helping people avoid common mistakes, though it cannot alone prevent over-indebtedness, which is influenced by social, economic, and psychological factors. An integrated debt advice which combines financial, legal, and psychological support is vital. Support organisations must avoid stigmatizing indebted entrepreneurs or consumers.

Microfinance institutions (MFIs) play a key role by offering tailored products to build financial resilience and by collaborating with debt advice services, municipalities, and tax authorities to create community-based support networks. Finally, participants called for greater EU regulatory harmonisation and stronger rules to curb high-risk lending practices such as “buy now, pay later” schemes.

To keep in mind:

Speakers voiced the following advice:

- Ensure access to financial education and make it an universal skill offered by microfinance institutions (MFIs) as they can play a key role by offering tailored products to build financial resilience and by collaborating with debt advice services, municipalities, and tax authorities to create community-based support networks. Finally, participants called for greater EU regulatory harmonisation and stronger rules to curb high-risk lending practices such as “buy now, pay later” scheme adapted to both consumers and entrepreneurs and embedded early through schools and lifelong learning.

- Integrated debt advice services should combine financial, legal, and psychological support, offered proactively and without stigma.

- MFIs should develop tailored tools to strengthen financial resilience and coordinate closely with municipalities, tax authorities, and other debt advice providers.

- EU-wide regulatory harmonisation and tighter rules on predatory credit practices are essential to prevent over-indebtedness and promote financial well-being.

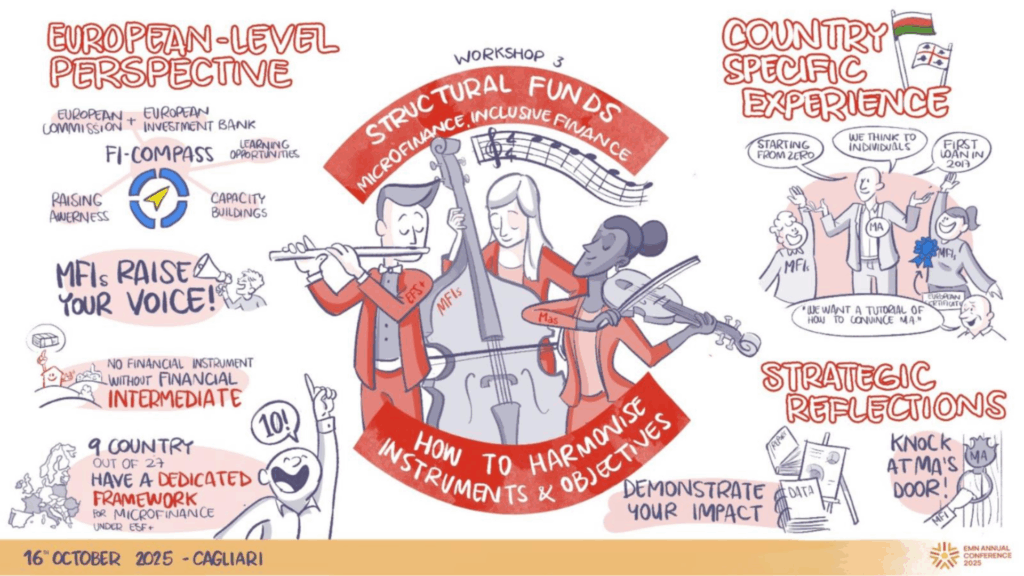

Workshop 3 - Structural Funds, Microfinance and Inclusive Finance - How harmonize instruments and objectives

Our speakers: Emanuele Cabras (Coopfin), Brigitte Fellahi-Brognaux (European Commission), Bruno Robino (EIB), Tzvetan Spassov (Bulgarian Ministry of Labour and Social), Martina Grigorova (SIS Credit), Gabriele Pazzola (Sardinia Region)

The workshop

The workshop aimed to examine how ESF+ and other Structural Funds can more effectively promote microfinance and inclusive finance initiatives across Member States, using examples from Italy and Bulgaria.

When it comes to share management funds like ESF +, EC encourages Managing Authorities to strengthen access to finance for vulnerable groups and entrepreneurs based. Under the current ESF+ programme, 200,000 micro-enterprises have been supported through ESF+. The discussion featured practical experiences from Bulgaria where speakers illustrated how the ESF-funded Risk-Sharing Microfinance Facility successfully mobilized over EUR 5 million for nearly 400 beneficiaries, creating more than 700 jobs and fostering inclusive entrepreneurship. In Italy regional-level strategies allowed the development of microfinance to achieve social and territorial cohesion goals. The Sardinian ESF+ managing authority is switching from an in-house management of the Microcredit Fund to an externalized management by the involvement of financial intermediaries (bank, MFIs).

The session explored ways to better align the objectives, timelines, and governance structures of structural funds and microfinance to enhance social impact. It highlighted the importance of collaboration among EU institutions, managing authorities, and microfinance organizations, underscoring the role of both financial and non-financial support in promoting inclusive entrepreneurship.

To keep in mind:

Within the current programming period and for the next one, the objective is to create more cooperation between managing authorities and microfinance institutions to scale up successful models.

- Extend the number of ESF+ managing authorities (currently 10 countries) implementing microcredit financial instruments.

- Enhance coordination and peer learning among Managing Authorities to replicate successful models, such as Bulgaria’s Risk-Sharing Facility;

- Microfinance institutions to be seen as strategic partners for both lending and non-financial support, including business advice and training;

- Combine microcredits with grants to increase access for vulnerable entrepreneurs and social enterprises;

- For the sector the key is to make sure to demonstrate the impact in order to enter a positive circle;

- Streamline administrative procedures to accelerate implementation and reduce barriers;

- Promote recycling and long-term sustainability of financial instruments and encourage flexible and targeted financial instruments

- Align 2028–2034 cohesion policy with financial inclusion priorities, supporting social innovation, job creation, and inclusive entrepreneurship.

- For MAs: conduct a thorough analysis of local microfinance needs and collaborate with financial intermediaries who understand the needs of high-risk clients.

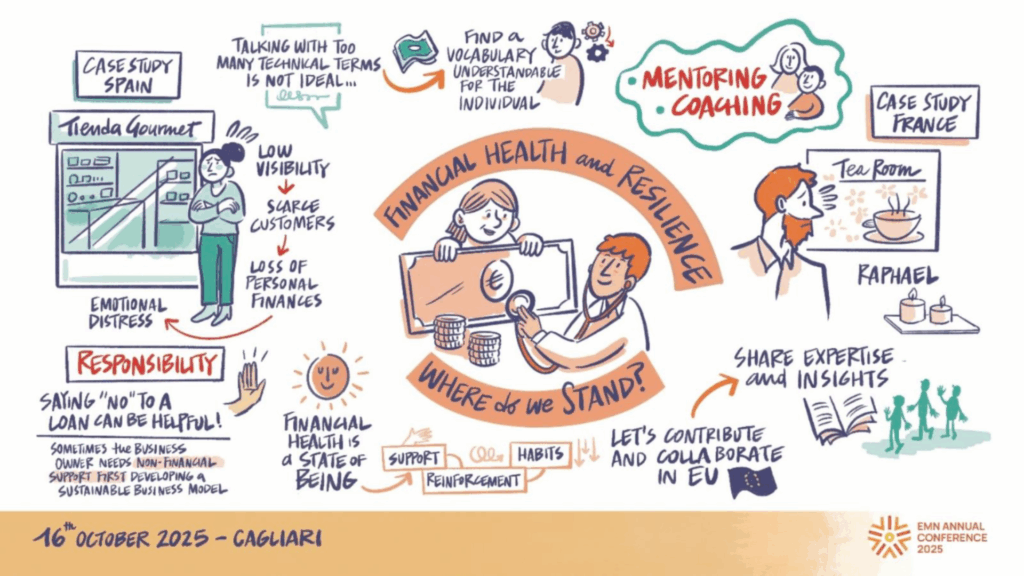

Workshop 4 - Financial health and resilience

Our speakers: Jo Gray (Youth Business International), Jerome Collin (Cresus Foundation), Karla Estrada (Nantik Lum Foundation), Adelaide Jomier (Adie), Marion Bind (Fundación Tomillo)

The workshop

Ensuring the long-term sustainability and performance of entrepreneurs and micro-businesses requires strengthening their financial health and resilience. Financial health indicators are important for microfinance institutions (MFIs) and enterprise support organisations (ESOs) alike, as they offer valuable insights into the challenges entrepreneurs face and how effective the support provided is. Collaborating with ESOs enables MFIs to combine financial services with capacity-building and advisory support, helping entrepreneurs to address personal and business-related financial issues.

Entrepreneurs benefit most from a non-directive, non-judgemental approach that prioritises their agenda and challenges. Financial stress has a direct negative impact on performance. It is critical to involve entrepreneurs in finding solutions. Building new financial habits and behaviours takes time — typically six to twelve months — and should address key aspects such as managing spending, building emergency savings and fostering collaboration with peers and support networks.

Sharing good practices and conducting regular impact assessments is essential to identify what works, where and why, and to continuously improve existing support methodologies. Given the resource constraints of MFIs, closer collaboration with local ESOs could be a more cost-effective way of strengthening entrepreneurs’ financial resilience. Finally, Financial health indicators such as savings (emergency savings) and the ratio between debt and income can help MFIs to make better informed decisions about loan provision and identify non-financial service needs.

To keep in mind:

Financial Health vs Financial Literacy vs Financial Health

- Financial health measures outcomes and behaviours.

- Financial literacy is about understanding financial concepts and tools.

- Financial management is about planning, monitoring, and controlling personal & business finances.

- Literacy is necessary, but health comes from action and consistency.

Pathway from Financial Literacy to Financial Health in Entrepreneurship

- Financial Literacy (Knowing)

- Financial Management (Doing)

- Support & Reinforcement

- Habit Formation

- Financial Health (Being)

Financial health indicators need to be communicated in a language that is understood and has meaning for entrepreneurs, e.g. talk about savings rather than liquidity.

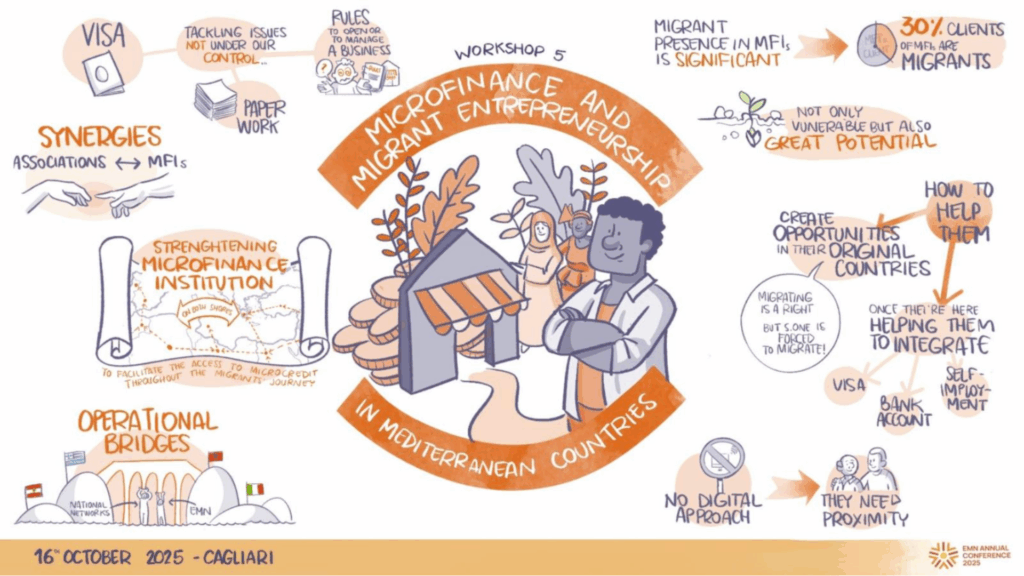

Workshop 5 - Microfinance and Migrant Entrepreneurship in Mediterranean Countries

Our speakers: Katia Raguzzoni (Microfinanza), Martin Klaucke (European Commission), Daniele Panzeri (IOM), Giulia Boioli (PerMicro), Stamatis Velegrakis (AFI), Antonio Sierra (Treball Solidari)

The workshop

The workshop aimed to explore the key tools and procedures for enhancing the operational capacity of microfinance institutions in supporting migrants in the Mediterranean Region.. According to the EMN and MFC data Report from 2024 (from 2024), migrants account for 13% of all microfinance clients.

From the microfinance side, PerMicro reported similar trends in Italy, noting that 12% of businesses are founded by migrants, and nearly half of its clients (49%) are migrants. The main challenge for migrants is visa renewal delays, which often prevent loan approvals due to invalid identity documents. PerMicro lending strategy focuses on addressing concrete and essential needs for migrants clients (which are very similar to non-migrant clients). AFI provided insights from Greece, where limited financial education and the temporary status of many migrants make providing business support challenging. Greece, like several other countries in the Mediterranean region, is a transit country for many migrants, which makes the provision of financial and non-financial services even more complex. Many entrepreneurs plan to move on to northern Europe, complicating efforts for long-term assistance. Treball Solidari shared experiences from Mallorca, where 30% of residents are foreign-born. The presentation emphasized leveraging migrants’ existing skills, citing and noted that even modest funding can help migrant entrepreneurs achieve remarkable results.

IOM outlined its role in linking migration and development, particularly through remittances. The International Organisation for Migration stressed the importance of reducing barriers to sending and investing money in host countries, as well as co-financing projects in migrants’ countries of origin to promote local development.

DG MENA described EU initiatives supporting migrants, including matching skills with jobs and providing psychosocial support highlighting the need for clear regulations, digital tools, and mentoring to enable migrants to succeed as entrepreneurs.

To keep in mind

- Microfinance is much more than just finance. It should foster strong linkages among financial institutions to enhance financial inclusion, especially for people moving across borders and promote the creation of regional and transnational networks of microfinance institutions to ensure that migrants receive consistent financial services and advisory support throughout their journey from their countries of origin, through transit, to their destinations.

- Simplify procedures with a more human and social centric approach for migrants to go through the administrative formalities, open bank accounts and simplify procedures to create companies

- Develop flexible microfinance solutions that address the specific circumstances of migrants, including temporary legal status, limited collateral, and mobility constraints. Create a global digital credit profile or wallet so that a migrant’s repayment history in their home country helps them access credit in Europe.

- Encourage the use of remittances not just for consumption, but also as investment capital and as a source of loan guarantees, thereby connecting remittance flows to productive economic activities.

- Use digital tools and financial technologies more widely to improve accessibility and efficiency.

- Work in partnership with international organisations, such as the International Organisation for Migration (IOM), to design and implement innovative financing mechanisms and integration programmes that address the diverse needs of migrants.

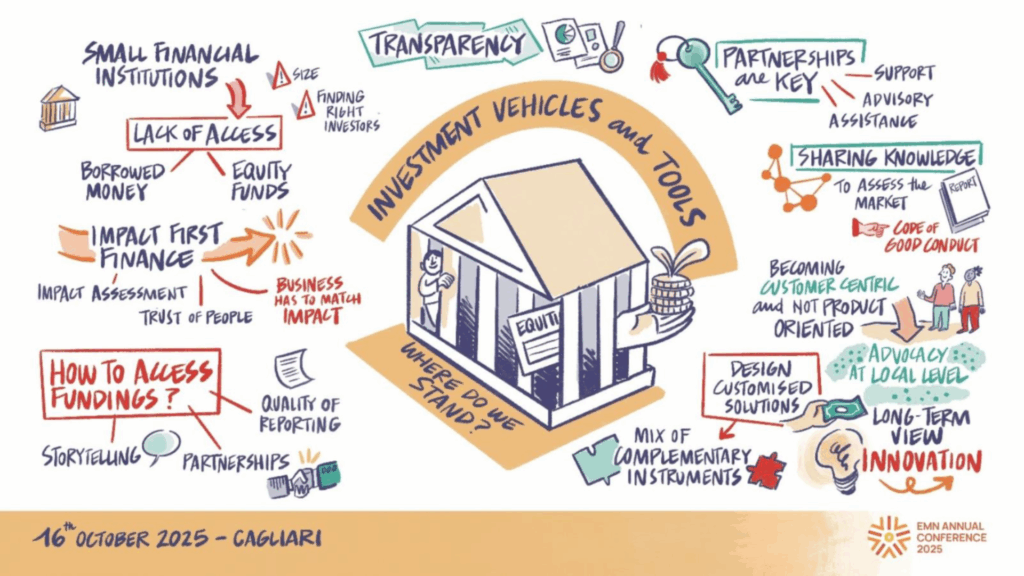

Workshop 6 - Investments vehicles and tools. Where do we stand?

Our speakers: Fabio Malanchini (Impactage), Stefano Baldussi (Banca Etica), Cristina Dumitrescu (EIF ), Francesco Grieco (Inpulse), Rory Bruce (VisionFund)

The workshop

Microfinance institutions face significant challenges in accessing finance; this is not a surprise. They often struggle not only with borrowing funds but also with raising equity, as a solid capital position is essential to attract investors. The MFI sector itself is highly fragmented, ranging from very small local players to large international organisations, which complicates standardised investment approaches.

In Europe, funding options are relatively limited compared to other regions, with the European Investment Fund (EIF) and the Council of Europe Development Bank (CEB) being the primary sources of support for the sector.

To improve access to finance, MFIs need to embed high-quality impact measurement and reporting into their core strategy. Storytelling and showcasing real-life examples of impact are crucial to engaging investors. It is equally important to ensure that an organisation mission is aligned with its operational activities, demonstrating clear procedures for achieving impact goals, including integrating social scoring into business plans.

Building and nurturing partnerships is vital, as MFIs cannot operate in isolation: strong personal relationships with investors, combined with visible commitment and passion from the team, foster trust. Standardising reporting across the sector can simplify processes for both MFIs and investors, enhancing transparency and comparability.

MFIs can also strengthen their financial position by leveraging complementary instruments, such as combining capacity-building support, guarantees, technical assistance, grants, or mixed instruments, which can help attract further investment. Finally, opening up equity to external investors is increasingly important for MFIs seeking sustainable growth and the ability to scale their operations.

To keep in mind:

- Strengthen impact measurement and reporting: Integrate robust, high-quality impact measurement systems into the core strategy. Use clear metrics, transparent reporting and compelling storytelling to showcase real-life outcomes and build investor confidence.

- Align mission with operations: Ensure that the organisation mission is consistently reflected in its operational activities (e.g. clear procedures for achieving impact goals, incorporate social scoring into business planning and decision-making).

- Diversify and combine financial instruments: Strengthen financial resilience by leveraging complementary instruments such as capacity-building support, technical assistance, guarantees, grants and blended finance models.

- Expand equity participation: Consider opening up equity to external investors as a strategic step to support sustainable growth, improve capital adequacy and scale operations effectively.

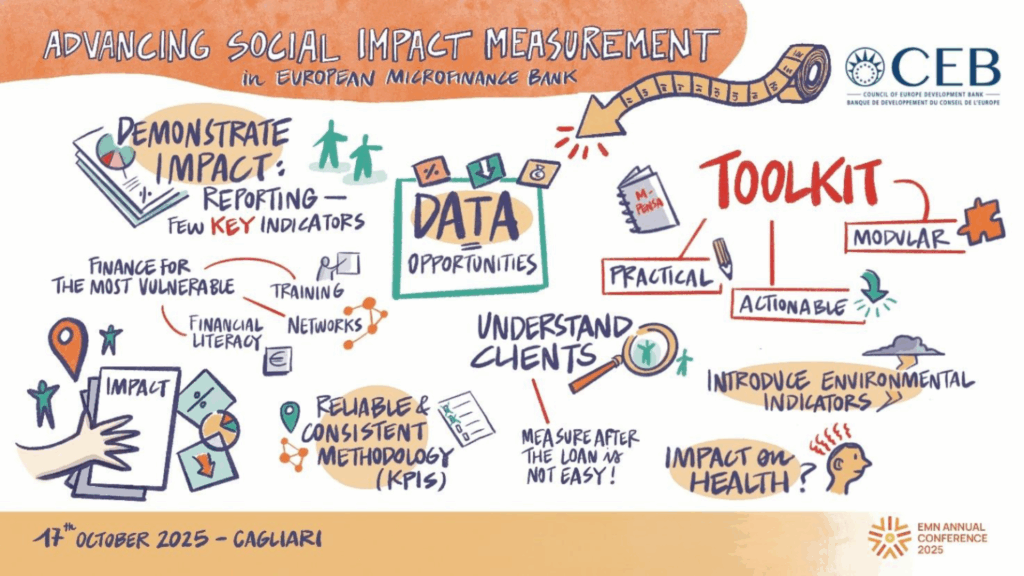

CEB Workshop - Advancing Social Impact Measurement in European Microfinance Bank

Our speakers: Kristina Maslauskaite (CEB), Brigitte Fellahi-Brognaux (European Commission), Davide Castellani (M-Pensa), Linas Armalys (Noviti Finance), Martina Grigorova (SIS credit), PerMicro (Filippo Chiesa)

The workshop

In its 2023–2027 Strategic Framework, the Council of Europe Development Bank (CEB) identifies microfinance as a key sector of activity and highlights the importance of measuring social outcomes to ensure that support effectively reaches the most vulnerable populations. As part of its role as Implementing and Advisory Partner under the EU’s InvestEU Programme, the CEB also supported the development of a Social Impact Measurement Toolkit for Microfinance Providers in Europe, created in collaboration with M-Pensa Impact & Development Services. The toolkit provides microfinance providers (MFPs) with a practical, stakeholder-informed framework for measuring and reporting social outcomes, thereby strengthening transparency, comparability, and decision-making across the sector.

The workshop offered an opportunity to hear directly from microfinance institutions—SIS Credit (Bulgaria), PerMicro (Italy), and Noviti Finances (Lithuania)—which are benefitting from InvestEU Advisory support implemented by the CEB. These institutions shared how they assess the social impact of their activities in practice, discussing the methods and tools they are developing, as well as the challenges they face in collecting consistent and meaningful data. Participants underscored that effective impact assessment not only enhances accountability and transparency, but also supports institutional growth by informing strategic decisions, attracting investors, and improving the quality and relevance of services delivered to clients.

To keep in mind

- Recommendation: Social impact measurement is increasingly essential, and no longer optional, for accessing concessional resources, and the CEB is supporting this shift by developing an open-source tool to help microfinance providers measure their impact effectively.

- Next steps: Microfinance providers are invited to review the beta version of the toolkit available on the CEB website and share their feedback, which will be essential as the tool is further developed throughout 2026.

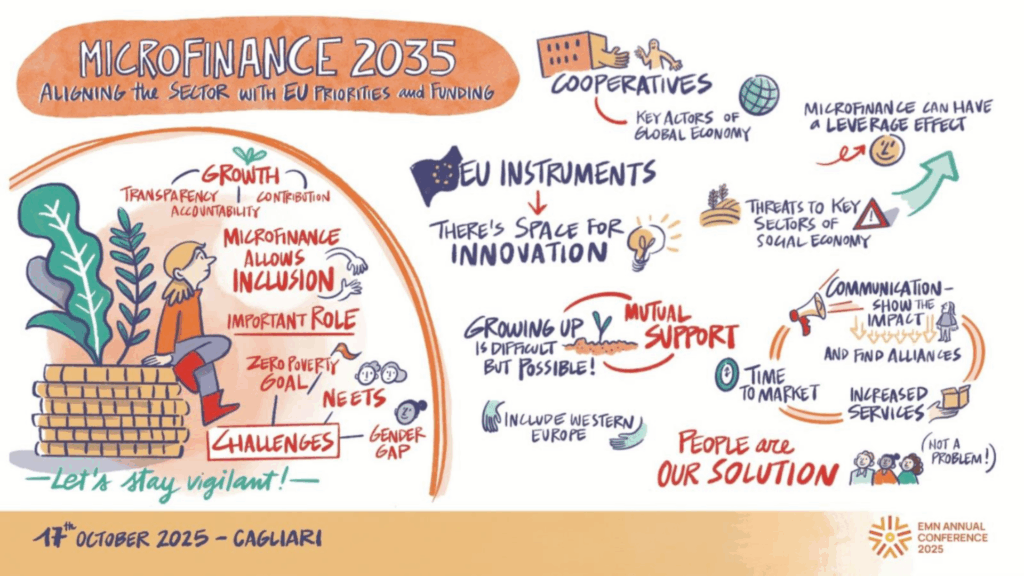

Closing panel - Microfinance 2035: aligning the sector with EU priorities and funding

Our speakers: Stefan Buciuc (BCR Social Finance and EMN), Laure Coussirat-Coustère (Adie and EMN), Cristina Dumitrescu (EIF), Bruno Robino (EIB), Antonio Sierra (Treball Solidari), Marco Marcocci (Confcooperative)

The workshop

The workshop highlighted the role of microfinance in promoting financial inclusion, poverty reduction, and social empowerment.

Adie and Treball Solidari shared insights on their operations, challenges, and impact, emphasizing that microfinance is not only about scale but about growing capable actors within the sector. Practitioners underlined the importance of EU level programs continuity (InvestEU and ESF+), their timely implementation, and the need to pursue tailored technical assistance to strengthen microfinance institutions.

Participants stressed the need to increase visibility and recognition of microfinance’s social impact, integrating standardized indicators to measure outcomes effectively. Microfinance should be positioned as a strategic EU priority, both within Europe (EC, Parliament, EIB, EIF, CEB) and in EU countries, with regulatory frameworks and financial instruments supporting sector growth. Expanding microfinance into diverse sectors, such as agriculture, and using it as a tool for entrepreneur empowerment is also essential for sustainable development.

To keep in mind:

- Continue the dialogue with EC and Parliament to find the best way to support microfinance and social economy in EU and candidate countries

- Ensure continuity and timely transition of programs to avoid market gaps (with special attention to securing needed amounts for financial instruments, especially guarantees, in next MFF) develop diverse funding instruments, and create more flexible financial support for non-profit and social economy organisations.

- Promote microfinance social impact and improve sector visibility at the political and societal level and create three to five key indicators that all microfinance providers can consistently measure and make these accessible to organisations of all sizes.

- Address regulatory barriers to foster growth and investment, with special focus on smaller financial institutions and impact measurement

- Integrate and increase the role microfinance into EU policies and priorities, extending relevant instruments to candidate countries.

- Encourage innovation, deregulation and creative disruption to strengthen sector resilience and effectiveness.

- Share concrete success stories with policymakers and the public to demonstrate the real-world impact of microfinance and use personal stories to illustrate how microfinance changes lives and show how microfinance contributes to broader goals such as social inclusion, gender equality and entrepreneurship, and push for social impact to become a priority pillar in EU funding.

- Explore cross-sector synergies (e.g. microfinance in agriculture and the green transition) and support the growth of small and medium-sized microfinance organisations.

- Continue the development of the European Code of Good Conduct, creating consistent standards across different regions and organisations.